Forex trading is all about understanding how different currencies interact with each other. One important concept in this field is currency correlation, which significantly shapes trading strategies and risk management. By understanding currency correlations, traders can make smarter decisions and improve their chances of success in the forex market.

What Are Currency Correlations?

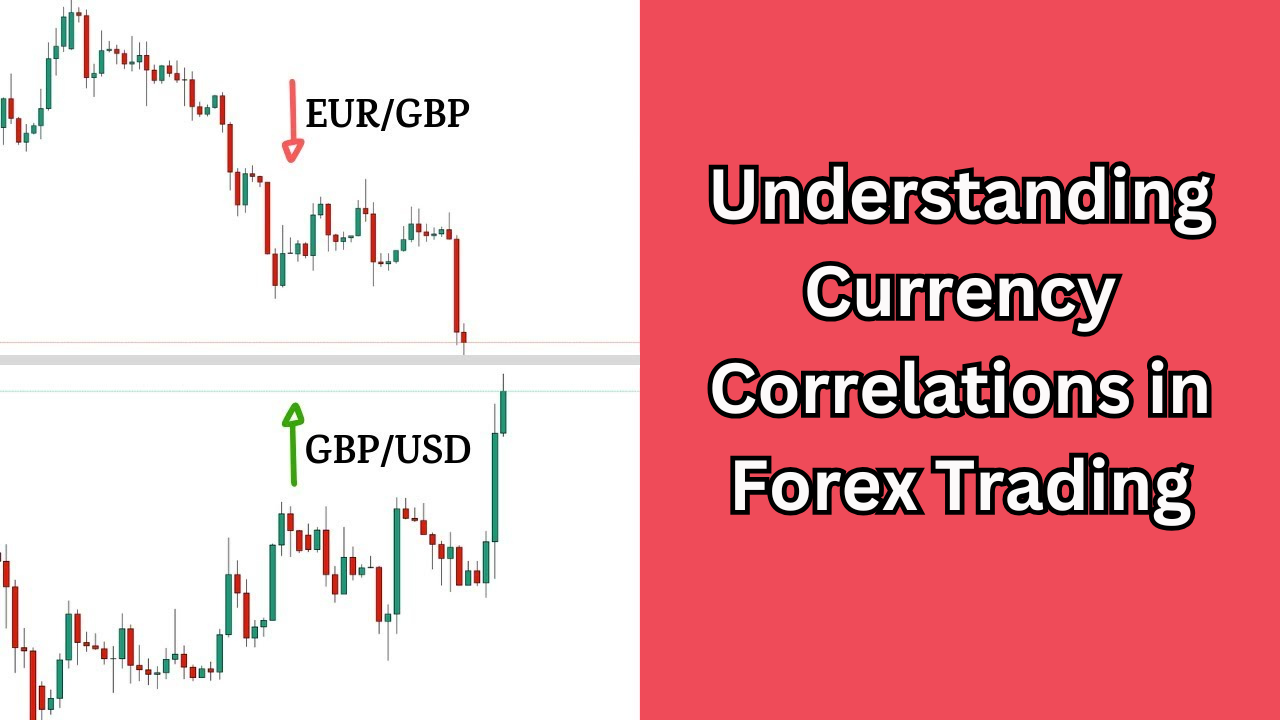

Currency correlation refers to the relationship between two currency pairs. It shows how the price movements of one currency pair relate to another. For example, if two currency pairs move in the same direction most of the time, they have a positive correlation. On the other hand, if they move in opposite directions, they have a negative correlation. The correlation is weak or neutral if there is no consistent pattern in their movements.

Correlations are usually measured on a scale from -1 to +1. A correlation of +1 means the two currency pairs always move in the same direction, while -1 means they always move in opposite directions. A correlation close to 0 indicates no significant relationship.

Why Currency Correlations Matter in Forex Trading:

Knowing how currencies are connected helps traders in many ways. It helps them manage risk better. If traders know which currency pairs move together, they can avoid putting too much risk on one trend. For example, if a trader buys two currency pairs that usually move in the same direction, they are doubling their risk. This means both pairs will likely change the same way, which can increase potential losses. By avoiding this, traders can make smarter choices and have a better chance of success in the forex market.

Second, currency correlations can help traders identify new opportunities. For example, if one currency pair starts to move, it might indicate that a related pair could follow the same trend. This can give traders a chance to enter the market before the second pair makes a big move.

Lastly, knowing how currencies are connected helps traders understand the bigger market. Countries that trade a lot with each other often have currencies that move together. By studying these links, traders can learn more about the world economy and make better decisions.

Examples of Common Currency Correlations:

Some currency pairs are known to have strong correlations due to economic or geographical ties. For example, the EUR/USD and GBP/USD pairs often show a positive correlation. This is because the economies of the Eurozone and the United Kingdom are closely linked. When the US dollar strengthens or weakens, it tends to affect both pairs similarly.

Another example is the USD/JPY and USD/CHF pairs. These pairs often show a positive correlation because both Japan and Switzerland are seen as safe-haven economies. When investors seek stability, the currencies of these countries tend to react in similar ways.

On the other hand, some pairs have a negative correlation. For instance, the USD/JPY and EUR/USD pairs often move in opposite directions. This is because when the US dollar strengthens against the Japanese yen, it often weakens against the euro, and vice versa.

Factors That Influence Currency Correlations:

Several factors can impact the correlation between currency pairs. One major factor is economic conditions. Countries with strong trade or investment ties often have positively correlated currencies. For example, Australia and New Zealand share significant economic links, so their currencies (AUD and NZD) tend to move together.

Another factor is market sentiment. During times of uncertainty, investors often move their money into safe-haven currencies like the US dollar, Swiss franc, or Japanese yen. This can cause strong correlations between safe-haven currency pairs during volatile market conditions.

Central bank policies also play a role. If two central banks have similar monetary policies, their currencies are more likely to show a positive correlation. Conversely, if their policies are very different, their currencies might show a negative correlation.

Lastly, geopolitical events can shift correlations. For example, changes in trade agreements, political instability, or global crises can influence how currency pairs move relative to each other.

How to Use Currency Correlations in Trading:

Traders can use currency correlations in several ways to improve their strategies. One common approach is to diversify trades. Instead of placing all their money in positively correlated pairs, traders can spread their investments across pairs with different correlations. This reduces the risk of significant losses if the market moves unexpectedly.

Another strategy is to hedge trades. If a trader is uncertain about the direction of one pair, they can place an opposite trade on a negatively correlated pair. This can help offset potential losses.

Traders can also use correlations to confirm trends. If two positively correlated pairs are moving in the same direction, it can add confidence that the trend is strong. Conversely, if they are moving in opposite directions, it might signal that the trend is weakening.

Limitations of Currency Correlations:

While currency correlations can be a valuable tool, they are not always consistent. Correlations can change over time due to shifts in economic conditions, market sentiment, or geopolitical events. For this reason, traders need to regularly update their analysis and not rely solely on past correlation data.

It’s also important to remember that correlation does not imply causation. Just because two pairs are correlated does not mean one causes the other to move. Traders should combine correlation analysis with other tools and techniques to make informed decisions.

Conclusion:

Currency correlations are an important part of forex trading. They show how currency pairs move together. By understanding these relationships, traders can make better decisions, manage risks, and find opportunities. For example, if two currencies move in the same direction, buying both can increase risk. Knowing this helps traders avoid mistakes.

Traders use this knowledge to plan their trades and improve their performance. But it’s important to remember that these correlations can change over time. So, traders need to stay updated on market conditions. By keeping an eye on these changes and analyzing the data, traders can navigate the forex market more effectively. This helps them increase their chances of success and make smarter trading decisions.